Chaz and I semi look back at the year of doing adult things, being responsible and preparing for the future. Now that the holiday seasons upon us. The anxiety of not having fun and doing things other than being an adult has become frustrating. What can a single millennial do when stagnant life becomes boring. Also a short review of Black Friday and impulse buying.

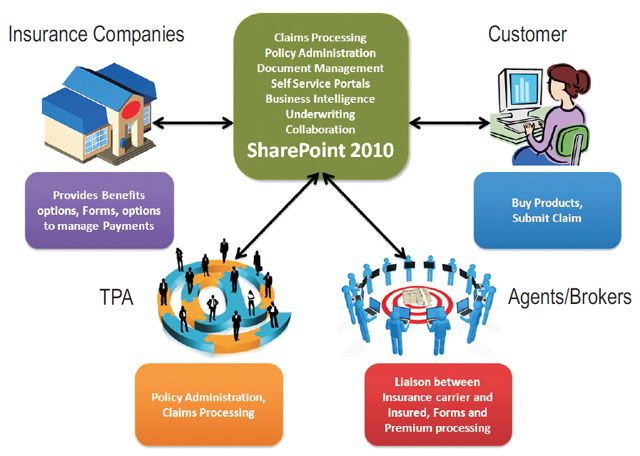

Life insurance with Super Agent Jeremy Goodrich Part 2

On part two of our sit down with Insurance guru Jeremy Goodrich. We go a little abstract out side of life insurance and ask a few different insurance questions that effects us all. Jeremy shocks us on things that if you aren't really experienced insurance person you would be stumped. Follow Jeremy on the following platforms:

Shine insurance agency

Shine insure.com

Shineinsure: twitter

Shine insure: instagram

Shine Insurance Agency: Facebook

Podcast:

Scratch entrepreneur.com

Itunes podcast

youtube podcast

Life insurance with Super Agent Jeremy Goodrich Part 1

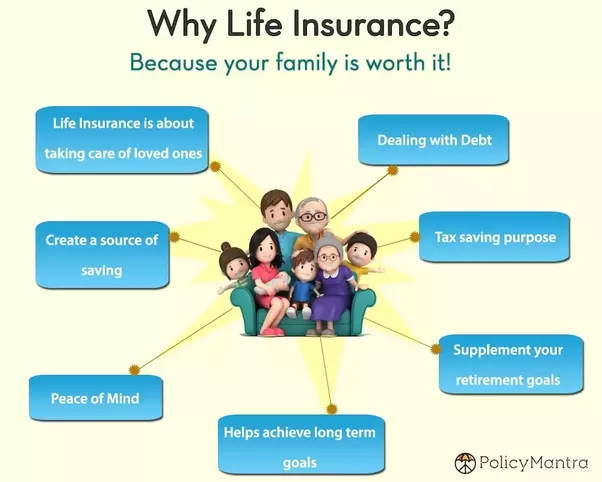

This episode Chaz and I welcome a special guest to speak about the unsexy life of insurance. We were approached by a member of the welcome to the wall crew, and asked, what are good options for life insurance as a young millennial. Chaz and I reached out to super agent Jeremy Goodrich from Shine insurance to fill us in on the unsexiness of insurance and what we don't know and what we should know. We discuss options with Life insurance, investments and the little things we missed without talking to an expert.

Term Life - Term pays only if death occurs during the term of the policy

(1 - 30 years)

Whole Life - Whole pays a death benefit whenever you die. even if you live to 100

Universal Life - UL the excess of premium payments above the current cost of insurance

is credited to the cash value of the policy

Variable Universal Life - VUL is a permanent life insurance policy with an investment component. The policy has a cash value account, which is invested in a number of sub-accounts available in the policy.

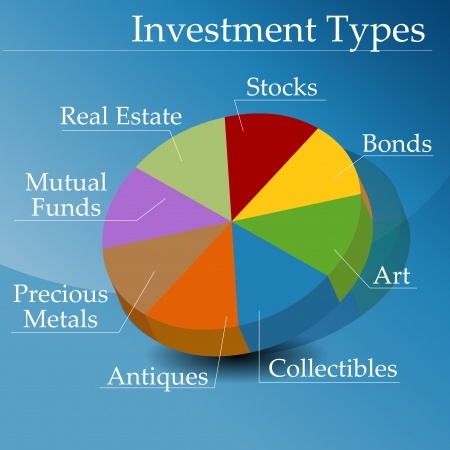

Investment Options for the Millennial

Tonight Chaz and I discuss investments people can look at as an alternative to savings accounts. We discuss stocks, mutual funds, money markets, CD's and just options other than sitting your money in an account that will only give you less than 0.5%. Some of the Welcome to the wall crew joins us to discuss financial options early in their life.

Coming from the hood and into the middle class (Changes)

On this Episode of our financial series, Chaz and I speak to Jeremy Jacobs a member from the group Welcome to the Wall . This young gentleman from humble beginnings has achieved a lot in his life thus far to do better and be better. His unique work experience and life experience lead us to add him into our discussion about handling your finances under different circumstances. Such as:

- Travel for your job - Per diem

- Building relationships - Vehicle, Uber, Public Transportation

- Savings, investment - Banking

A good discussion for young Millennials who work under different conditions